Sell Your Mobile phone & Pills For cash Today

Posts

- Financial institutions Offering Cellular Take a look at Dumps

- Install The new Pursue Cellular Software

- Is it Illegal For A keen Inmate To have Dollars?

- Delight in A far more Environmentally friendly Banking Routine With Estatements

- Log on to Cellular Banking

- Preferred Errors To stop When Deposit Checks

Following, smack the digital camera icon on your cellular app to open up the newest cam. Of many mobile banking apps provide mobile protection announcements or Texting text message notice, that will help you stick to greatest out of possibly fake pastime. Such as, Investment You to definitely Cellular app profiles is also set up Text messages ripoff notification away from Eno, the capital One virtual assistant. In the event the Eno observes any unusual hobby, it can touch base that have a text message. Funding One customers is install the administrative centre One Cellular application to start making mobile deposits now.

- Fortunately, for many who financial that have a lending institution that has a mobile app, you may not must visit a branch to put a great take a look at.

- Display your account, and when the cash doesn’t appear after a fourteen days, check out a lender department and provide the newest report take a look at because the research of the put.

- We are not contractually compelled at all to offer self-confident otherwise recommendatory reviews of its characteristics.

- Really loan providers features each other a monthly and you can a regular put limitation.

The balance uses just high-top quality offer, along jackpotcasinos.ca go to these guys with fellow-assessed knowledge, to support the details within our posts. Read all of our article way to find out more about exactly how we fact-consider and keep maintaining our articles precise, legitimate, and dependable. After you fill in their deposit, you’ll constantly score a message verifying bill, and you will receive another one telling your that put try acknowledged. Find the account you should deposit the fresh check up on and fill out the quantity .

Financial institutions Offering Cellular Take a look at Dumps

To possess mobile deposits, the main city One Cellular application will show their maximum put count. If you would like put an amount that is more than the restrict, check out a department or Money One Automatic teller machine. Zero, you do not shell out a fee after you build a deposit for the your own Financing You to user examining otherwise family savings. You can link their qualified examining otherwise savings account in order to a keen account you’ve got in the some other bank. Performing this enables you to effortlessly transfer finance between the accounts.

Install The new Pursue Cellular Software

Cellular places may take differing time period to pay off, dependent on numerous items as well as both parties’s standard bank, membership records and you may membership types. Money are offered once deposit but could sometimes get several business days to pay off. A trip deposit membership are a checking account to possess funding fund that gives the advantages of one another a discount and you will an examining membership. For individuals who refuge’t downloaded debt institution’s mobile software, you’ll need to do that it before you make a cellular deposit. You typically are able to find your bank’s app for the App Store and you can Yahoo Enjoy networks.

Sign up and then we’ll send you Nerdy content in regards to the currency subject areas one amount really to you personally together with other a way to help you get far more from your money. Investment One to, advises people to attract a small mark for each part, which wouldn’t harm the newest look at however, do help you understand. We believe people can generate financial choices with trust. Is actually carrying the phone flat over the take a look at, ensuring that the new view is in interest and the visualize isn’t too small. Inspections made payable so you can anyone apart from on your own and you will one joint account holders. In case your photos is not some really good, the new software would not make sure whether the consider try legitimate and the view can not be confirmed.

Rebecca has been dealing with individual fund for more than seven many years. Their performs might have been authored inside the MarketWatch, You.S. Development & Community Declaration, or other publications, and you can she’s contributed pro comments in order to Chance, Money, NBC, and.

Is it Illegal For A keen Inmate To have Dollars?

The new Chase checking customers take pleasure in a $three hundred bonus once you open a great Pursue Overall Examining membership making direct places totaling $five hundred or higher in this 90 days of discount enrollment. Get more from a personalized relationship giving no everyday banking fees, concern provider away from a devoted team and you will unique benefits and advantages. Apply at a good Chase Private Client Banker at the nearest Pursue branch to know about qualification conditions and all of available professionals. Most financial institutions have some sort of constraints to your every day, per week or monthly deposits. Monitors exceeding it restrict may prefer to getting deposited individually.

Delight in A far more Environmentally friendly Banking Routine With Estatements

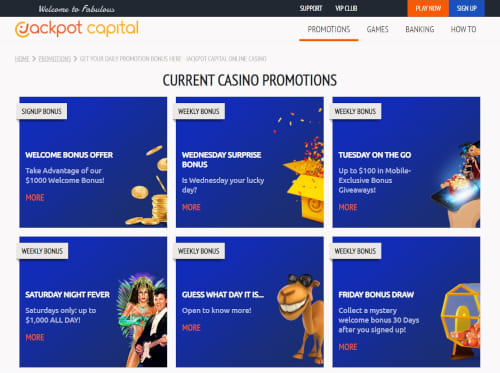

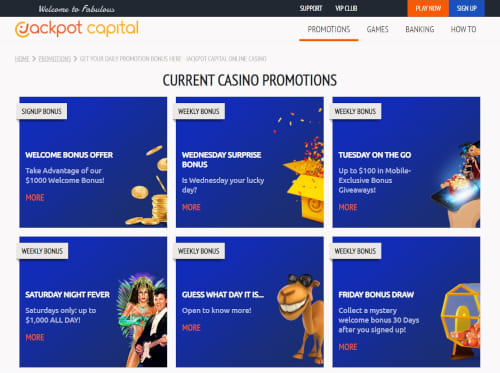

Without the need private banking advice becoming common during the transactions, players can also enjoy greater comfort when designing dumps and distributions off their account. These types of purchase in addition to lets users to keep best track of their paying if you are however viewing on line enjoyment. Very incentives will be supplied to users no matter what they choose to put. An element of the exemption is if a casino explicity prohibits pay thru mobile deposit actions otherwise now offers a no-deposit bonuses that really needs one to has an excellent debit credit for the document. With the rapid dumps and you will withdrawals, web based casinos one to deal with Trustly try big with Brits. Once you deposit as a result of Trustly, you’lso are depositing from your bank account, however with one very important caveat.

Log on to Cellular Banking

Cellular consider deposit is a straightforward and you will safe solution to deposit your money in the family savings without having to make the trip to an actual place. Most major financial institutions render this service to help save time and effort if you are still conference all your economic means. Just beware of any possible constraints prior to mobile dumps. As with fundamental look at places, mobile view places can also be jump even after you get verification. For example, the newest take a look at is going to be came back if the photographs try illegible or as the look at issuer features shortage of money within their account.

Preferred Errors To stop When Deposit Checks

Make certain tokeep your own sign in a secure area if you do not understand the complete deposit amount listed in your account’s past/previous transactions. Contain the sign in a comfort zone through to the fund have removed in your membership. The same as a lender statement, you ought to dispose of the fresh look at securely just after time has introduced. To help you deposit the brand new take a look at as a result of a lender application, capture a photo from each party.